Harnessing the Power of Lower Interest Rates: 3 Strategies You Should Use

In a financial climate where lower interest rates have become increasingly prevalent, savvy buyers must not miss the opportunity to capitalize on these favorable conditions. As the global economy responds to fluctuating market pressures, banks and financial institutions are adjusting their interest rates accordingly. Lower interest rates open the door for cost-effective borrowing, and if prepared, buyers can take advantage to not only reach but exceed their financial goals. Here are three valuable strategies to ensure you are well-prepared to harness the power of lower interest rates.1. Strengthen your Credit Score:Your credit score plays a critical role in leveraging lower interest rates. A higher credit score indicates financial responsibility and lowers risk for lenders, which can lead to better loan terms, including lower interest rates. Start by obtaining a free credit report and reviewing it for any errors. Paying off any outstanding debts, maintaining low credit card balances, and making all payment on time are effective strategies to improve your overall credit score. There are also credit repair services and financial advisors available to assist you if needed.2. Save for a Down Payment:Another effective way to take advantage of lower interest rates is by saving for a hefty down payment. The more you save for a down payment, the less you'll have to borrow, and the less you borrow, the less you'll pay in interest over the life of the loan. Determining the amount to save will depend on your financial goals and the specific purchase you're planning—whether it's buying a house, a car, or investing. Ideally, aim to save at least 20% of the purchase price as a down payment. 3. Research and Compare Lenders:Not all lenders will offer you the same interest rate. Taking the time to research and compare your options enables you to secure the best possible deal. Tools such as loan comparison websites can provide insights into different lenders' offerings, but it's also beneficial to have direct conversations with these financial institutions. Look for credible lenders who maintain transparency and offer a competitive interest rate that suits your financial circumstances. Conclusion:Lower interest rates provide an excellent opportunity for buyers to maximize their purchasing power and save money in the long run. By fortifying your credit score, saving for a substantial down payment and diligently researching potential lenders, you can put yourself in the best position to benefit from times of lower interest rates. Remember, preparation is key in making the most of these favorable financial conditions. So, are you ready to springboard your financial goals to the next level using these strategies? The stage is set for you to seize the moment and take advantage of lower interest rates. Don't miss out on this unprecedented financial opportunity. Note: This blog article is for general educational and informational purposes only. It does not constitute financial advice. Please consult with a certified financial advisor or your bank for advice tailored to your circumstances.

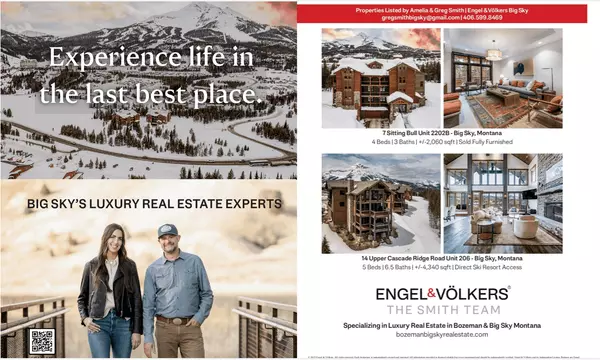

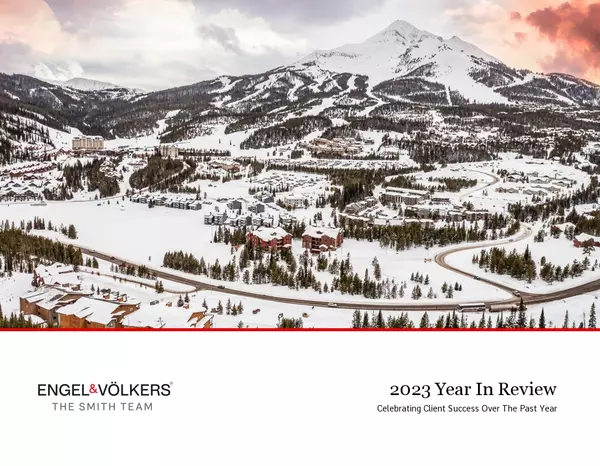

2023 Year In Review

We've had the pleasure of helping more than 36 clients buy, sell and invest in real estate, totaling in more than $38 million in total sales volume. We're grateful to be among the top producing agents in Southwest Montana, and look forward to carring that success into 2024! Explore the epitome of luxury living in Bozeman and Big Sky, Montana, as we showcase our most exceptional home sales from the past year. From breathtaking mountain retreats to exquisite properties that embody the Montana lifestyle. Take a look below! 2023 Year In Review

Navigating the Homeownership Journey: Five Essential Tips for First-time Home Buyers

When embarking on an exhilarating journey - like venturing into homeownership for the first time - it's vital to equip yourself with the necessary guidance and knowledge. Buying a home is indeed one of the most significant milestones many of us dream to achieve, but it can also be fraught with challenges, particularly for the uninitiated. Here's a precious guide that shines a spotlight on five key tips that can turn first-time home buyers into savvy homeowners. 1. Embrace the Power of Savings Whether it's a stylish loft or a sprawling mansion you're eyeing, buying a home requires considerable financial outlay. It's noteworthy that homeownership isn't merely about paying the home's ticket price; it encompasses miscellaneous expenses such as closing costs, home insurance, and potential renovation costs. Therefore, a robust savings strategy should be your launching pad. Experts advise tucking away at least 20% of the property's value for a down payment to avoid the extra cost of private mortgage insurance (PMI). 2. Know Your Credit Score Landscape Nothing influences your mortgage's approval and interest rates more than your credit score. Ensure you hop onto this journey with a solid credit rating under your belt. If your score is wanting, consider taking the necessary steps to improve it, such as paying off debt and consistently meeting bill deadlines. Keep a keen eye on your credit report to ensure its accuracy, rectifying any discrepancies that could tarnish your creditworthiness. 3. Get Pre-Approval Before House Hunting Imagine falling in love with the perfect house, only to realize you can't afford it. You can prevent such heartbreak by getting a mortgage pre-approval. This not only provides a clear picture of the price range within your means, but it also gives you a competitive edge. Sellers are more likely to favor buyers who have pre-approvals since it reduces the chances of deal collapse due to financing. 4. Do Your Homework - Location Matters While that slopeside condo or downtown Bozeman condo could be an architectural masterpiece, remember that location is king in real estate. It’s prudent to study the locale before committing to a mortgage, as it dictates aspects such as property appreciation, school quality, and proximity to essential services. Also, consider how the location aligns with your lifestyle and long-term plans. 5. Engage The Services Of A Reputable Realtor As a first-time home buyer, it's crucial to have a reliable and experienced realtor by your side. They bring to the table a wealth of knowledge about the real estate market, excellent negotiation skills, and invaluable connections. Ensure that your realtor understands your needs, preferences, and budget to find a home that dovetails into your aspirations perfectly. Regardless of its complexities, the journey to becoming a first-time homeowner doesn't have to be arduous. With the right tools and guidance, your road to homeownership can be a joyous adventure leading you to the doorstep of your dream home. Following these five tips will steer you towards smarter decisions, foster savvy home buying habits and ultimately, illuminate the path towards owning the key to your first home.

Categories

Recent Posts